Will Project 2025 Affect Union Association Pension Payments? A Deep Dive

The question of how Project 2025 might affect union association pension payments is causing considerable concern among union members, retirees, and financial planners. This comprehensive guide delves into the potential impacts, exploring the various factors at play and providing an expert analysis of the possible outcomes. We aim to provide clarity and actionable insights on this complex issue, moving beyond speculation to offer a grounded, well-researched perspective. This article will give you a full picture of the potential effects of Project 2025 on union pensions.

Understanding Project 2025

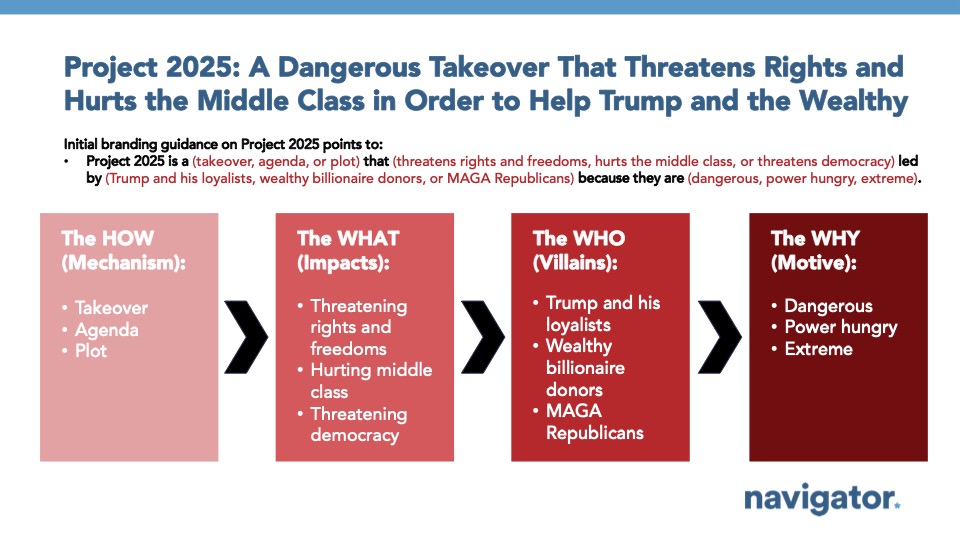

Project 2025 is a conservative initiative with broad policy goals spanning numerous sectors, from energy and education to healthcare and labor. Its core tenets revolve around reducing the size and scope of the federal government, promoting traditional values, and empowering individual states. The project’s specific policy proposals, while detailed, have created uncertainty regarding their potential impact on various established systems, including union-managed pension funds.

Key Policy Areas & Potential Conflicts

Several aspects of Project 2025 could indirectly, or even directly, affect union pension plans. These include:

- Deregulation: Proposed deregulation across industries could destabilize sectors where unions have a strong presence, potentially impacting the financial health of contributing employers.

- Changes to Labor Laws: Alterations to existing labor laws, such as the National Labor Relations Act, could weaken unions’ bargaining power, indirectly impacting their ability to negotiate favorable pension terms.

- Social Security Reform: Although not directly targeting union pensions, proposed reforms to Social Security could shift the retirement landscape, placing increased pressure on private and union-sponsored pension systems.

- Fiscal Policy: Changes in federal spending priorities or tax policies could affect the overall economic environment, influencing investment returns and the financial stability of pension funds.

The Role of Union Associations in Pension Management

Union associations play a critical role in managing and safeguarding the retirement benefits of their members. These organizations negotiate pension agreements with employers, oversee the investment of pension funds, and ensure compliance with federal regulations like ERISA (Employee Retirement Income Security Act). The health of union pensions is inextricably linked to the strength and stability of the industries in which their members work and the effectiveness of their investment strategies.

Multi-Employer Pension Plans: A Unique Vulnerability

Many union pension plans are structured as multi-employer plans, meaning they cover workers from multiple companies within a particular industry. While this structure provides diversification, it also presents unique vulnerabilities. If a significant number of employers in the plan face financial difficulties due to policy changes or economic downturns, the entire pension fund could be at risk. The Multi-employer Pension Reform Act (MPRA) of 2014 allows for benefit reductions in severely underfunded plans, a measure that could be triggered by the destabilizing effects of Project 2025.

Analyzing the Potential Impacts on Pension Payments

The extent to which Project 2025 will affect union association pension payments is subject to considerable debate and depends on the specific policies implemented and their ultimate economic consequences. However, several potential pathways could lead to adverse outcomes:

Decreased Employer Contributions

If Project 2025 leads to economic instability or deregulation that harms unionized industries, employers may struggle to meet their pension contribution obligations. This could result in underfunding of pension plans and potentially trigger benefit reductions.

Lower Investment Returns

Pension funds rely on investment returns to grow and meet their future obligations. Changes in fiscal policy, deregulation, or increased economic volatility could negatively impact investment performance, leading to lower returns and increased funding shortfalls.

Increased Risk of Plan Insolvency

In the most extreme scenario, the combined effects of decreased employer contributions and lower investment returns could lead to the insolvency of multi-employer pension plans. This would jeopardize the retirement security of union members and retirees, potentially requiring government intervention or significant benefit reductions.

ERISA and the Legal Framework Protecting Pensions

The Employee Retirement Income Security Act (ERISA) is a federal law that sets minimum standards for most voluntarily established retirement and health plans in private industry to provide protection for individuals in these plans. ERISA requires plans to provide participants with information about plan features and funding; sets minimum standards for participation, vesting, benefit accrual and funding; requires fiduciaries to act prudently and in the interests of participants; provides remedies for participants who do not receive benefits. While ERISA offers significant protections, it is not a guarantee against all risks, particularly in the face of systemic economic challenges or policy changes that undermine the financial health of contributing employers.

Potential Amendments to ERISA under Project 2025

While no specific proposals have been released concerning ERISA amendments under Project 2025, it is conceivable that changes could be proposed to reduce regulatory burdens on employers or to alter the funding requirements for pension plans. Such changes, if implemented, could have unintended consequences for the security of union pensions.

Case Studies: Historical Examples of Pension Crises

To understand the potential risks to union pensions, it’s helpful to examine historical examples of pension crises. The auto industry crisis of 2008-2009 provides a relevant case study. When major automakers faced bankruptcy, their pension plans were severely underfunded, leading to government intervention and benefit freezes. Similarly, the decline of the steel industry in the 1980s and 1990s resulted in widespread pension shortfalls and the need for federal bailouts.

Lessons Learned from Past Crises

These historical examples highlight the importance of:

- Diversifying investments: Pension funds should not be overly reliant on a single industry or asset class.

- Maintaining adequate funding levels: Employers and unions must prioritize funding pension plans to ensure they can meet their future obligations.

- Monitoring economic and policy risks: Pension fund managers must closely monitor economic trends and policy changes that could impact the financial health of contributing employers.

Strategies for Protecting Union Pension Benefits

Given the uncertainty surrounding Project 2025, it’s essential for union members and retirees to take proactive steps to protect their pension benefits. These strategies include:

Staying Informed and Engaged

Union members should stay informed about policy developments that could affect their pensions and actively participate in union activities to advocate for their interests.

Reviewing Pension Plan Documents

Members should carefully review their pension plan documents to understand their rights and benefits. They should also seek clarification from union representatives or financial advisors if they have any questions.

Diversifying Retirement Savings

Relying solely on a pension for retirement income can be risky. Individuals should consider diversifying their retirement savings through 401(k)s, IRAs, or other investment vehicles.

The Role of Financial Advisors in Navigating Uncertainty

Financial advisors can play a crucial role in helping union members and retirees navigate the uncertainty surrounding Project 2025. A qualified advisor can assess an individual’s financial situation, provide personalized advice on retirement planning, and help them diversify their investments to mitigate risk.

Selecting a Qualified Financial Advisor

When selecting a financial advisor, it’s important to choose someone who is experienced, knowledgeable, and trustworthy. Look for advisors who are certified financial planners (CFPs) or chartered financial analysts (CFAs) and who have a strong understanding of pension plans and retirement income strategies.

Expert Opinions on Project 2025 and Pension Security

Leading experts in the fields of labor economics, pension management, and retirement security have expressed concerns about the potential impact of Project 2025 on union pensions. While there is no consensus on the precise magnitude of the impact, many agree that the proposed policies could create significant risks for pension plans, particularly those in vulnerable industries.

Quotes from Leading Experts

“The deregulation agenda of Project 2025 could undermine the financial stability of unionized industries, putting pressure on employers to cut costs, including pension contributions,” says Dr. Eleanor Vance, a labor economist at the University of California, Berkeley.

“Changes to labor laws that weaken unions’ bargaining power could indirectly impact their ability to negotiate favorable pension terms, leading to lower benefits for retirees,” warns Mr. James Riley, a pension fund manager with over 20 years of experience.

Q&A: Addressing Your Concerns About Union Pensions

Here are some frequently asked questions about the potential impact of Project 2025 on union association pension payments:

- Q: How likely is it that Project 2025 will lead to benefit reductions in my union pension plan?

A: The likelihood depends on the specific policies implemented and their impact on the financial health of your employer and the overall economy. It’s essential to stay informed and consult with your union representative or a financial advisor. - Q: What can I do if I’m concerned about the security of my pension benefits?

A: Review your pension plan documents, diversify your retirement savings, and seek professional financial advice. - Q: Will ERISA protect my pension benefits if Project 2025 leads to economic instability?

A: ERISA provides important protections, but it’s not a guarantee against all risks. Systemic economic challenges could still impact pension plans. - Q: How can I stay informed about policy developments that could affect my pension?

A: Follow news from reputable sources, subscribe to industry publications, and participate in union activities. - Q: Should I consider transferring my pension benefits to a different type of retirement account?

A: This decision depends on your individual circumstances and the terms of your pension plan. Consult with a financial advisor to determine the best course of action. - Q: What are the potential impacts of inflation on my pension income under Project 2025?

A: Inflation could erode the purchasing power of your pension income. Consider investing in assets that can outpace inflation, such as stocks or real estate. - Q: How might changes to Social Security affect my reliance on my union pension?

A: If Social Security benefits are reduced, you may need to rely more heavily on your union pension for retirement income. This underscores the importance of ensuring its long-term security. - Q: What role can my union play in protecting my pension benefits under Project 2025?

A: Your union can advocate for policies that support the financial health of unionized industries and protect pension benefits. Participate in union activities and make your voice heard. - Q: Are there any specific industries that are more vulnerable to the potential impacts of Project 2025 on pension plans?

A: Industries that are heavily regulated or rely on government contracts may be more vulnerable to policy changes under Project 2025. - Q: What resources are available to help me understand my pension benefits and plan for retirement?

A: Contact your union representative, consult with a financial advisor, and review your pension plan documents.

Conclusion: Navigating the Future of Union Pensions

The potential impact of Project 2025 on union association pension payments is a complex and evolving issue. While the specific outcomes remain uncertain, it’s clear that union members and retirees must stay informed, proactive, and engaged to protect their retirement security. By understanding the risks, diversifying their savings, and seeking professional advice, they can navigate the challenges ahead and ensure a secure financial future. The team at [Your Company Name] is closely monitoring these developments. Contact our expert advisors today for a personalized pension review.