How to Get My Child a Cash App Card: A Parent’s Expert Guide

Are you looking for a safe and convenient way to give your child access to funds while teaching them financial responsibility? Getting a Cash App card for your child might be the perfect solution. However, navigating the process and understanding the nuances of using Cash App for minors can be tricky. This comprehensive guide will walk you through every step, ensuring you make informed decisions and set your child up for financial success. We’ll cover everything from eligibility requirements to safety tips, providing you with the knowledge and confidence to get your child a Cash App card responsibly.

This article provides a detailed, expert-backed guide on how to get my child a Cash App card. We go beyond the basics, exploring the intricacies of Cash App’s policies, parental controls, and security measures. You’ll learn how to apply for a card, manage your child’s spending, and address potential issues. This guide is designed to be the most comprehensive and trustworthy resource available, giving you the peace of mind that you’re making the right choices for your child’s financial future.

Understanding Cash App and Its Features for Young Users

Cash App is a popular mobile payment service that allows users to send and receive money, invest, and even use a debit card linked to their account. For parents, it can be a useful tool to provide allowances, teach budgeting, and monitor spending. However, it’s crucial to understand how Cash App works for younger users.

Cash App now offers accounts for users 13-17 years old, with parental permission. This is a significant change from its previous policy, which required users to be 18 or older. This new feature allows teenagers to have their own Cash App accounts, complete with a Cash Card, making it easier for them to manage their money. Parents must approve the account and have oversight into their teen’s transactions.

Key Features for Teen Accounts

- Parental Approval: A parent or guardian must approve the teen’s account.

- Spending Limits: Parents can set spending limits to help their children manage their money responsibly.

- Transaction Monitoring: Parents can monitor their child’s transactions to ensure they are using the app safely and appropriately.

- Direct Deposit: Teens can receive direct deposits from jobs, making it easier for them to manage their earnings.

- Cash Card: A customizable debit card linked to the Cash App account.

Step-by-Step Guide: How to Get Your Child a Cash App Card

Getting a Cash App card for your child involves a few simple steps. Here’s a detailed guide:

- Ensure Eligibility: Your child must be between 13 and 17 years old.

- Create a Cash App Account (if necessary): If your child doesn’t already have a Cash App account, they will need to download the app and create one.

- Parental Approval Request: The child will initiate the process of requesting parental approval through the app.

- Parent Approval: As the parent, you will receive a notification to approve your child’s account. You will need to verify your identity and agree to the terms and conditions.

- Order the Cash Card: Once the account is approved, your child can order a Cash Card through the app. They can customize the card with their own design or choose from pre-designed options.

- Activate the Card: Once the card arrives, your child will need to activate it through the app.

Detailed Explanation of Cash App for Teens

Cash App’s teen accounts are designed to provide a safe and controlled environment for young users. Here’s a closer look at how it works:

Setting Up the Account

The process begins with the teen downloading the Cash App and initiating the account creation. They will need to provide basic information, such as their name, date of birth, and contact details. Once the initial setup is complete, the app will prompt them to request parental approval. This is a crucial step, as it ensures that a parent or guardian is aware of and consents to the teen’s use of the app.

Parental Oversight and Control

When the teen requests parental approval, the parent receives a notification. The parent must then verify their identity and agree to the terms and conditions of the teen account. This process typically involves providing their social security number and other identifying information. Once the parent approves the account, they gain access to several control features.

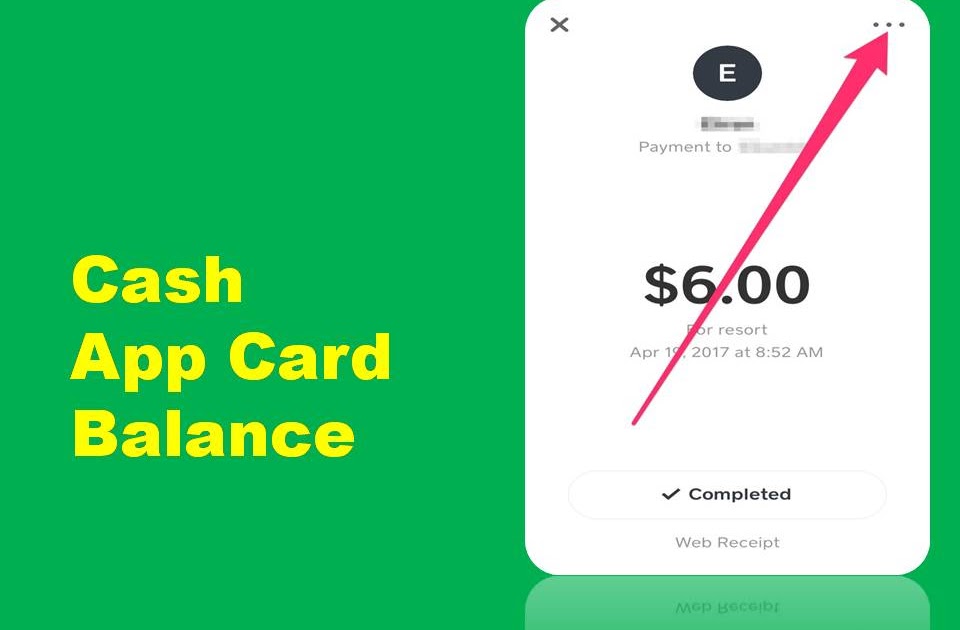

- Transaction Monitoring: Parents can view all transactions made by their teen, including the date, time, amount, and recipient. This allows them to keep track of their child’s spending habits and identify any suspicious activity.

- Spending Limits: Parents can set daily, weekly, or monthly spending limits to help their teen manage their money responsibly. This feature is particularly useful for teaching budgeting skills.

- Cash Card Control: Parents can control the use of the Cash Card, including the ability to lock or unlock the card, set spending limits, and restrict certain types of transactions.

Cash Card Customization

One of the appealing features of the Cash App card is the ability to customize it. Teens can choose from a variety of pre-designed options or create their own design by adding text, emojis, or drawings. This allows them to express their personality and make the card their own. However, it’s important to note that Cash App has guidelines for card customization, and certain types of content may be prohibited.

Advantages of Getting a Cash App Card for Your Child

There are several advantages to getting a Cash App card for your child:

- Financial Education: It provides an opportunity to teach your child about money management, budgeting, and responsible spending.

- Convenience: It’s a convenient way to give your child access to funds without having to carry cash.

- Safety: It’s safer than carrying cash, as the card can be locked or canceled if lost or stolen.

- Monitoring: Parents can monitor their child’s spending and ensure they are using the app safely and appropriately.

- Direct Deposit: Teens can receive direct deposits from jobs, making it easier for them to manage their earnings.

Potential Risks and How to Mitigate Them

While Cash App offers many benefits, it’s essential to be aware of the potential risks and take steps to mitigate them:

- Scams and Fraud: Teens can be vulnerable to scams and fraud, so it’s important to educate them about these risks and how to avoid them.

- Overspending: Without proper guidance, teens may overspend. Setting spending limits and monitoring transactions can help prevent this.

- Privacy Concerns: It’s important to ensure that your child understands the privacy settings and how to protect their personal information.

- Unauthorized Transactions: If the card is lost or stolen, unauthorized transactions may occur. It’s important to lock the card immediately and report the incident to Cash App.

Tips for Safe Usage

- Educate Your Child: Teach them about online safety, scams, and responsible spending habits.

- Set Spending Limits: Use the spending limit feature to help your child manage their money.

- Monitor Transactions: Regularly review your child’s transactions to identify any suspicious activity.

- Enable Security Features: Use the security features, such as two-factor authentication and biometric login, to protect the account.

- Keep the Card Secure: Remind your child to keep their card secure and not share their PIN with anyone.

Cash App Card Review: Features, Pros, and Cons

The Cash App card offers a convenient way for teens to manage their money. Here’s a detailed review:

Features

- Customizable Design: Teens can personalize the card with their own design.

- Spending Limits: Parents can set spending limits to help their children manage their money.

- Transaction Monitoring: Parents can monitor their child’s transactions.

- Cash Boosts: Users can earn discounts at select merchants.

- ATM Access: Users can withdraw cash from ATMs (fees may apply).

Pros

- Convenient: Easy to use and manage.

- Customizable: Allows teens to express their personality.

- Parental Controls: Provides parents with oversight and control.

- Direct Deposit: Supports direct deposits from jobs.

- Cash Boosts: Offers discounts at select merchants.

Cons

- Fees: ATM fees and potential inactivity fees may apply.

- Security Risks: Vulnerable to scams and fraud.

- Spending Limits: May be restrictive for some users.

- Limited Functionality: Does not offer all the features of a traditional bank account.

Overall Verdict

The Cash App card is a useful tool for teaching teens about money management. However, it’s essential to be aware of the potential risks and take steps to mitigate them. With proper guidance and parental oversight, the Cash App card can be a valuable asset for young users.

Alternatives to Cash App for Teen Spending

While Cash App is a popular option, several alternatives offer similar features and benefits:

- Greenlight: A debit card and app specifically designed for kids and teens, with robust parental controls and educational features.

- GoHenry: Another debit card and app that focuses on financial education and parental oversight.

- Step: A free teen banking app with a secured Visa card and no monthly fees.

Q&A: Your Top Questions Answered About Cash App and Minors

- Can my 12-year-old use Cash App?

- What happens if my child turns 18 while using a teen Cash App account?

- Are there any fees associated with the Cash App card for teens?

- How can I report fraudulent activity on my child’s Cash App account?

- Can my child invest in stocks or Bitcoin through their teen Cash App account?

- What happens if my child loses their Cash App card?

- Can I link my bank account to my child’s Cash App account?

- How can I teach my child about budgeting using Cash App?

- Are there any restrictions on where my child can use their Cash App card?

- What if my child needs to send or receive more money than the set limit allows?

No, Cash App requires users to be at least 13 years old to have their own account with parental permission. A parent or guardian must approve the account.

Once your child turns 18, their Cash App account will automatically transition to a standard adult account, removing parental oversight.

While the Cash App card itself is free, ATM withdrawal fees may apply. Always check the fee schedule within the Cash App for the most up-to-date information.

You can report fraudulent activity directly through the Cash App. Navigate to the transaction in question and follow the prompts to report it as fraudulent.

No, teen Cash App accounts do not have access to the investing features (stocks and Bitcoin) available to adult users.

You can immediately lock the card through the Cash App to prevent unauthorized use. You can then order a replacement card through the app.

No, each Cash App account is linked to its own unique bank account or debit card. You cannot directly link your bank account to your child’s account.

Use the spending limit feature to set a budget for your child. Encourage them to track their spending and make informed decisions about how to allocate their funds.

Cash App may restrict certain types of transactions, such as those related to gambling or adult content. Parents can also set restrictions on specific merchants or categories.

You can temporarily adjust the spending limits through your parent account to accommodate larger transactions, but remember to revert the limits afterward to maintain control.

Conclusion: Empowering Your Child with Financial Tools

Getting your child a Cash App card can be a valuable step towards teaching them financial responsibility and independence. By understanding the features, benefits, and potential risks, you can make informed decisions and set your child up for success. Remember to educate your child about safe spending habits, monitor their transactions, and utilize the parental controls to ensure they are using the app responsibly. With the right guidance, the Cash App card can be a powerful tool for empowering your child to manage their money wisely.

Now that you understand how to get my child a Cash App card, consider exploring other resources on our site for more tips on financial literacy and responsible technology use. Share your experiences with getting your child a Cash App card in the comments below!