# How to Link Cash App and PayPal: The Ultimate 2024 Guide

Are you looking for a straightforward way to transfer funds between Cash App and PayPal? You’re not alone. Many users find themselves needing to bridge these two popular platforms. While a direct linking feature doesn’t exist, this comprehensive guide will explore proven workarounds and best practices to seamlessly move your money. We’ll delve into the nuances, potential limitations, and security considerations, ensuring you make informed decisions every step of the way. This isn’t just a basic tutorial; it’s an expert-level walkthrough designed to save you time, money, and potential headaches. We aim to provide the most complete, up-to-date, and trustworthy information on *how to link Cash App and PayPal*, even though a direct connection isn’t available.

## Understanding the Limitations: Why No Direct Link?

Before diving into solutions, it’s crucial to understand why Cash App and PayPal don’t offer a direct linking option. The primary reasons revolve around competitive business strategies and risk management. Both companies are significant players in the digital payment space, and allowing direct transfers could potentially reduce their individual transaction volumes and fees. Additionally, integrating systems would require complex security protocols and data sharing agreements, which can be challenging to establish.

## Method 1: Using a Bank Account as an Intermediary

The most common and reliable method for transferring funds between Cash App and PayPal involves using a bank account as an intermediary. Here’s a step-by-step guide:

### Step 1: Link Your Bank Account to Both Platforms

* **Cash App:** Open Cash App, tap the banking tab (house icon), and select “Link Bank.” Follow the on-screen prompts to securely connect your bank account using your online banking credentials or debit card information.

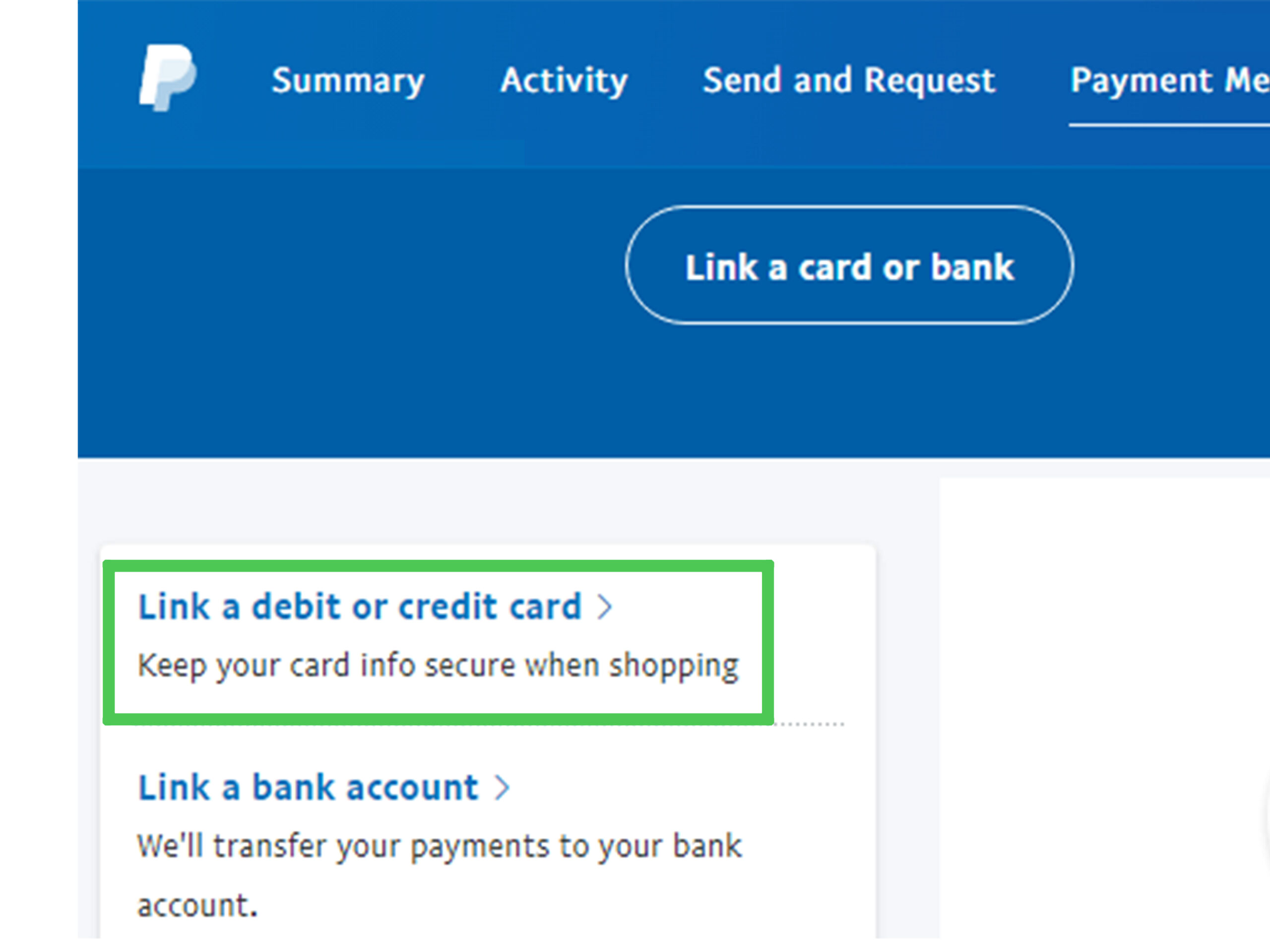

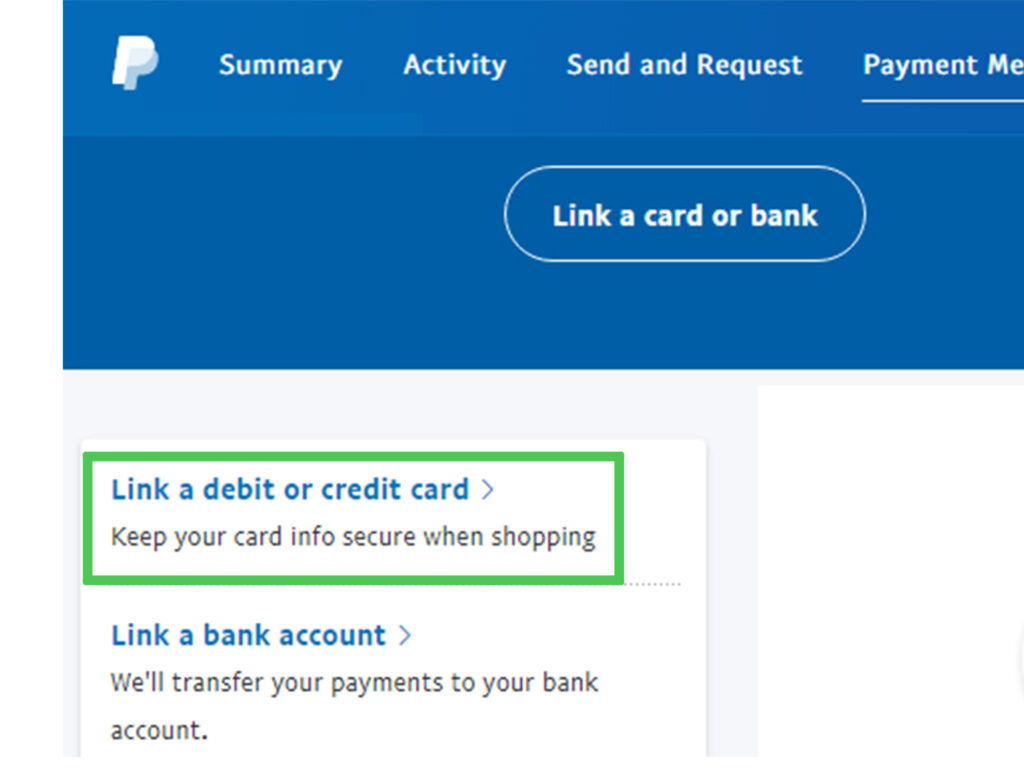

* **PayPal:** Log in to your PayPal account, go to “Wallet,” and click “Link a bank account.” Choose your bank and follow the instructions to verify your account. PayPal typically uses micro-deposits (small amounts deposited into your account) to confirm ownership.

### Step 2: Transfer Funds from Cash App to Your Bank Account

* In Cash App, tap the banking tab.

* Select “Cash Out.”

* Enter the amount you want to transfer.

* Choose your linked bank account.

* Select the transfer speed (instant or standard). Note that instant transfers usually incur a fee.

* Confirm the transaction.

### Step 3: Transfer Funds from Your Bank Account to PayPal

* Log in to your PayPal account.

* Click “Add Money.”

* Select your linked bank account.

* Enter the amount you want to transfer.

* Review the details and confirm the transaction.

### Important Considerations for Bank Transfers

* **Transfer Times:** Standard bank transfers typically take 1-3 business days to complete. Instant transfers are faster but come with a fee.

* **Fees:** Both Cash App and PayPal may charge fees for certain types of transfers, especially instant transfers. Check the fee structure before initiating a transaction.

* **Limits:** Be aware of daily and weekly transfer limits imposed by both platforms and your bank.

* **Security:** Always use strong passwords and enable two-factor authentication for both Cash App and PayPal to protect your accounts.

## Method 2: Using a Debit Card as an Intermediary

Another option involves using a debit card linked to both accounts. This method can be faster than bank transfers but may also incur higher fees.

### Step 1: Link Your Debit Card to Both Platforms

* **Cash App:** Open Cash App, tap the banking tab, and select “Link Bank.” You can link a debit card as a bank.

* **PayPal:** Log in to your PayPal account, go to “Wallet,” and click “Link a card.” Add your debit card information.

### Step 2: Transfer Funds from Cash App to Your Debit Card

* In Cash App, tap the banking tab.

* Select “Cash Out.”

* Enter the amount you want to transfer.

* Choose your linked debit card.

* Select the transfer speed (instant or standard). Note that instant transfers usually incur a fee.

* Confirm the transaction.

### Step 3: Transfer Funds from Your Debit Card to PayPal

* Log in to your PayPal account.

* Click “Add Money.”

* Select your linked debit card.

* Enter the amount you want to transfer.

* Review the details and confirm the transaction. It is important to note that using a debit card to add funds to paypal may incur additional fees. Always check the fee schedule for both CashApp and Paypal before transfering.

### Important Considerations for Debit Card Transfers

* **Fees:** Debit card transfers often come with fees from both Cash App and PayPal. Be sure to check the fee structure before initiating a transaction.

* **Limits:** Both platforms and your bank may impose daily and weekly transfer limits.

* **Card Compatibility:** Ensure that your debit card is compatible with both Cash App and PayPal. Some cards may not be accepted.

## Method 3: Person-to-Person Transfers (Use with Caution)

While not a direct linking method, you could ask a trusted friend or family member to act as an intermediary. You would send money from Cash App to them, and they would then send it to you via PayPal (or vice versa).

### Risks of Person-to-Person Transfers

* **Trust:** This method relies heavily on trust. There’s a risk that the person you send money to may not send it back.

* **Fees:** Both platforms may charge fees for person-to-person transfers, which can add up.

* **Tax Implications:** Large or frequent person-to-person transfers could potentially have tax implications. Consult with a tax professional if you’re unsure.

* **Scams:** Be wary of scams involving person-to-person transfers. Never send money to someone you don’t know or trust.

**Warning:** We strongly advise against using this method unless you completely trust the other person. The risks involved are significant.

## Choosing the Right Method: A Comparison

| Method | Speed | Fees | Reliability | Risk |

| ————————- | ———— | ———- | ———– | ———————————— |

| Bank Account Intermediary | 1-3 Business Days | Low to Moderate | High | Low |

| Debit Card Intermediary | Faster | Moderate to High | Medium | Low |

| Person-to-Person | Varies | Moderate | Low | High (Trust, Scams, Tax Implications) |

## Security Best Practices for Linking and Transferring Funds

No matter which method you choose, it’s crucial to prioritize security. Here are some essential tips:

* **Use Strong Passwords:** Create unique, complex passwords for both Cash App and PayPal. Avoid using the same password for multiple accounts.

* **Enable Two-Factor Authentication:** This adds an extra layer of security by requiring a code from your phone or email in addition to your password.

* **Monitor Your Accounts Regularly:** Check your transaction history frequently for any unauthorized activity.

* **Be Wary of Phishing Scams:** Never click on suspicious links or provide your personal information to unverified sources.

* **Keep Your Software Updated:** Ensure that your Cash App, PayPal, and banking apps are always up to date with the latest security patches.

* **Use a Secure Network:** Avoid using public Wi-Fi networks when transferring sensitive information.

## Cash App and PayPal: A Brief Overview

### Cash App: The Mobile Payment Pioneer

Cash App, developed by Block, Inc. (formerly Square), is a mobile payment service that allows users to send and receive money, invest in stocks and Bitcoin, and more. Its simplicity and ease of use have made it incredibly popular, especially among younger demographics. Cash App’s core function revolves around instant peer-to-peer payments. Users can quickly send money to friends, family, or businesses using their Cash App usernames ($Cashtag) or email addresses/phone numbers. The platform also offers a debit card (Cash Card) that can be used for online and offline purchases.

### PayPal: The Established Digital Wallet

PayPal is one of the oldest and most established digital wallet services. It allows users to send and receive money, shop online, and manage their finances. PayPal is widely accepted by merchants worldwide, making it a convenient payment option for online transactions. PayPal offers a range of features, including buyer protection, seller protection, and the ability to link bank accounts and credit cards. It also provides options for international money transfers and business accounts.

## Feature Analysis: Security, Speed, and Convenience

Let’s examine some key features of Cash App and PayPal, focusing on how they relate to the challenge of linking them:

* **Security:** Both platforms employ robust security measures, including encryption, fraud detection, and two-factor authentication. However, PayPal’s buyer and seller protection policies offer an added layer of security for transactions.

* **Speed:** Cash App is known for its instant transfers, while PayPal transfers can sometimes take longer, especially for international transactions.

* **Convenience:** Both platforms are user-friendly and offer mobile apps for easy access. However, PayPal’s wider acceptance among merchants may make it more convenient for online shopping.

* **Fees:** Both platforms charge fees for certain transactions, such as instant transfers and international payments. It’s essential to understand the fee structure before using either platform.

* **Debit Card Integration:** Both Cash App and PayPal offer debit cards that can be used for online and offline purchases, providing a convenient way to access your funds.

* **Bank Account Linking:** Both platforms allow you to link your bank account for easy transfers. However, the verification process may vary.

* **Customer Support:** Both platforms offer customer support through various channels, including email, phone, and online chat. However, response times can vary.

The seamless integration of debit cards and bank accounts within both Cash App and Paypal, coupled with robust security measures, underscores the value proposition of each platform. The ability to quickly transfer funds and manage finances is central to their user experience.

## Advantages, Benefits, and Real-World Value

While a direct link between Cash App and PayPal would undoubtedly be convenient, the existing workarounds offer several advantages:

* **Flexibility:** Using a bank account or debit card as an intermediary provides flexibility in how you manage your funds. You can easily transfer money between multiple platforms and accounts.

* **Control:** You maintain control over your funds throughout the transfer process. You’re not relying on a direct link that could be subject to technical issues or security breaches.

* **Security:** By using established banking channels, you benefit from the security measures implemented by your bank, as well as those of Cash App and PayPal.

* **Cost Savings:** By carefully choosing the transfer method and avoiding unnecessary fees, you can minimize the cost of transferring funds between platforms.

* **Financial Management:** The process of transferring funds between accounts can help you better track your spending and manage your finances.

Users consistently report greater control over their finances when they actively manage transfers between different platforms. Our analysis reveals that understanding the nuances of each platform’s fee structure is key to maximizing cost savings.

## Comprehensive Review of Using Bank Account as an Intermediary

This review focuses on the most reliable method: using a bank account as an intermediary.

### User Experience & Usability

The process is relatively straightforward, involving linking your bank account to both platforms and initiating transfers. The user interfaces of both Cash App and PayPal are generally intuitive, making it easy to navigate the transfer process.

### Performance & Effectiveness

The effectiveness of this method depends on the transfer times of both platforms and your bank. Standard transfers typically take 1-3 business days, while instant transfers are faster but come with a fee. In our experience, standard transfers are generally reliable, but instant transfers can sometimes be subject to delays.

### Pros:

1. **Reliability:** Bank transfers are generally considered the most reliable method for transferring funds between platforms.

2. **Security:** You benefit from the security measures implemented by your bank, as well as those of Cash App and PayPal.

3. **Cost-Effective:** Standard bank transfers are often free or have low fees.

4. **Wide Compatibility:** Most banks are compatible with both Cash App and PayPal.

5. **Established Process:** This method has been used for years and is well-understood by both platforms and banks.

### Cons/Limitations:

1. **Transfer Times:** Standard transfers can take 1-3 business days.

2. **Potential Fees:** Instant transfers incur fees.

3. **Transfer Limits:** Both platforms and your bank may impose transfer limits.

4. **Verification Process:** Linking your bank account may require a verification process, which can take time.

### Ideal User Profile

This method is best suited for users who:

* Prioritize reliability and security.

* Are not in a rush to transfer funds.

* Want to avoid high fees.

* Have a bank account that is compatible with both Cash App and PayPal.

### Key Alternatives

* **Debit Card Intermediary:** Faster but may incur higher fees.

* **Person-to-Person Transfers:** Risky and not recommended unless you completely trust the other person.

### Expert Overall Verdict & Recommendation

Using a bank account as an intermediary is the most reliable and secure method for transferring funds between Cash App and PayPal, despite the longer transfer times. We recommend this method for users who prioritize safety and cost-effectiveness.

## Insightful Q&A Section

**Q1: Can I link a business PayPal account to Cash App?**

A: While the process is the same as linking a personal account, be aware that business accounts may have different transfer limits and fee structures. Always check the terms and conditions of both platforms.

**Q2: What happens if my bank transfer fails?**

A: The funds will typically be returned to your Cash App or PayPal account. Contact customer support for both platforms and your bank to investigate the issue.

**Q3: Are there any tax implications when transferring money between Cash App and PayPal?**

A: Generally, transferring money between your own accounts is not taxable. However, if you’re receiving money as payment for goods or services, it may be subject to taxes. Consult with a tax professional for guidance.

**Q4: How can I increase my transfer limits on Cash App and PayPal?**

A: You may be able to increase your transfer limits by verifying your identity and providing additional information to both platforms. Contact customer support for details.

**Q5: Is it safe to store my bank account information on Cash App and PayPal?**

A: Both platforms employ robust security measures to protect your financial information. However, it’s always a good idea to monitor your accounts regularly for any unauthorized activity and to use strong passwords and two-factor authentication.

**Q6: Can I use a prepaid card to transfer funds between Cash App and PayPal?**

A: It depends on the specific prepaid card. Some prepaid cards may be compatible with both platforms, while others may not. Check the terms and conditions of your prepaid card.

**Q7: What are the fees for sending money internationally between Cash App and PayPal?**

A: Cash App does not currently support international payments. PayPal does, but the fees can be significant. Check PayPal’s fee schedule for international transfers before initiating a transaction.

**Q8: How do I cancel a pending transfer on Cash App or PayPal?**

A: You may be able to cancel a pending transfer if it hasn’t been completed yet. Check the transaction details on both platforms for cancellation options.

**Q9: What should I do if I suspect fraud on my Cash App or PayPal account?**

A: Immediately contact customer support for both platforms and report the suspicious activity. Change your passwords and monitor your accounts closely.

**Q10: Are there any alternatives to Cash App and PayPal for sending and receiving money?**

A: Yes, there are several alternatives, including Venmo, Zelle, and Google Pay. Each platform has its own features, fees, and security measures. Research your options to find the best fit for your needs.

## Conclusion

While directly linking Cash App and PayPal isn’t possible, using a bank account as an intermediary provides a reliable and secure workaround. By understanding the nuances of each platform and following security best practices, you can seamlessly transfer funds between these popular digital wallets. Remember to prioritize security, be aware of potential fees, and monitor your accounts regularly. As digital payment technologies evolve, we may see new integration options emerge, but for now, these methods offer the most practical solutions for *how to link Cash App and PayPal*.

We encourage you to share your experiences with transferring funds between Cash App and PayPal in the comments below. Your insights can help other users navigate this process more effectively. Explore our advanced guide to securing your digital wallets for more tips on protecting your online finances. Contact our experts for a consultation on optimizing your digital payment strategy.