Venmo to Apple Cash: The Ultimate Guide to Seamless Transfers

Are you looking for a way to transfer funds directly from Venmo to your Apple Cash card? You’re not alone. Many users find themselves needing this functionality, but the process isn’t always straightforward. This comprehensive guide will provide you with all the information you need to understand the possibilities and limitations of transferring money between Venmo and Apple Cash. We’ll explore alternative methods, troubleshoot common issues, and offer expert tips to ensure you can manage your funds effectively. Our goal is to provide a clear, trustworthy, and up-to-date resource that answers all your questions about moving money between these popular platforms. We aim to provide the most complete guide on transferring from Venmo to Apple Cash, and vice versa, and other alternatives.

Understanding the Landscape: Venmo, Apple Cash, and Interoperability

Venmo and Apple Cash are both popular digital payment platforms, but they operate within different ecosystems. Understanding their individual features and limitations is crucial before attempting any transfers.

Venmo: The Social Payment App

Venmo, owned by PayPal, is primarily designed for peer-to-peer (P2P) payments. It’s known for its social feed, where users can share (or keep private) their transactions with friends. Key features include:

* **Instant Transfers:** Venmo allows users to send and receive money quickly.

* **Social Feed:** A unique feature that adds a social element to payments.

* **Debit Card:** Venmo offers a debit card for spending your Venmo balance.

* **Business Profiles:** Businesses can use Venmo to accept payments.

* **Cryptocurrency Trading:** Venmo allows buying, selling, and holding cryptocurrency.

Apple Cash: Apple’s Digital Wallet

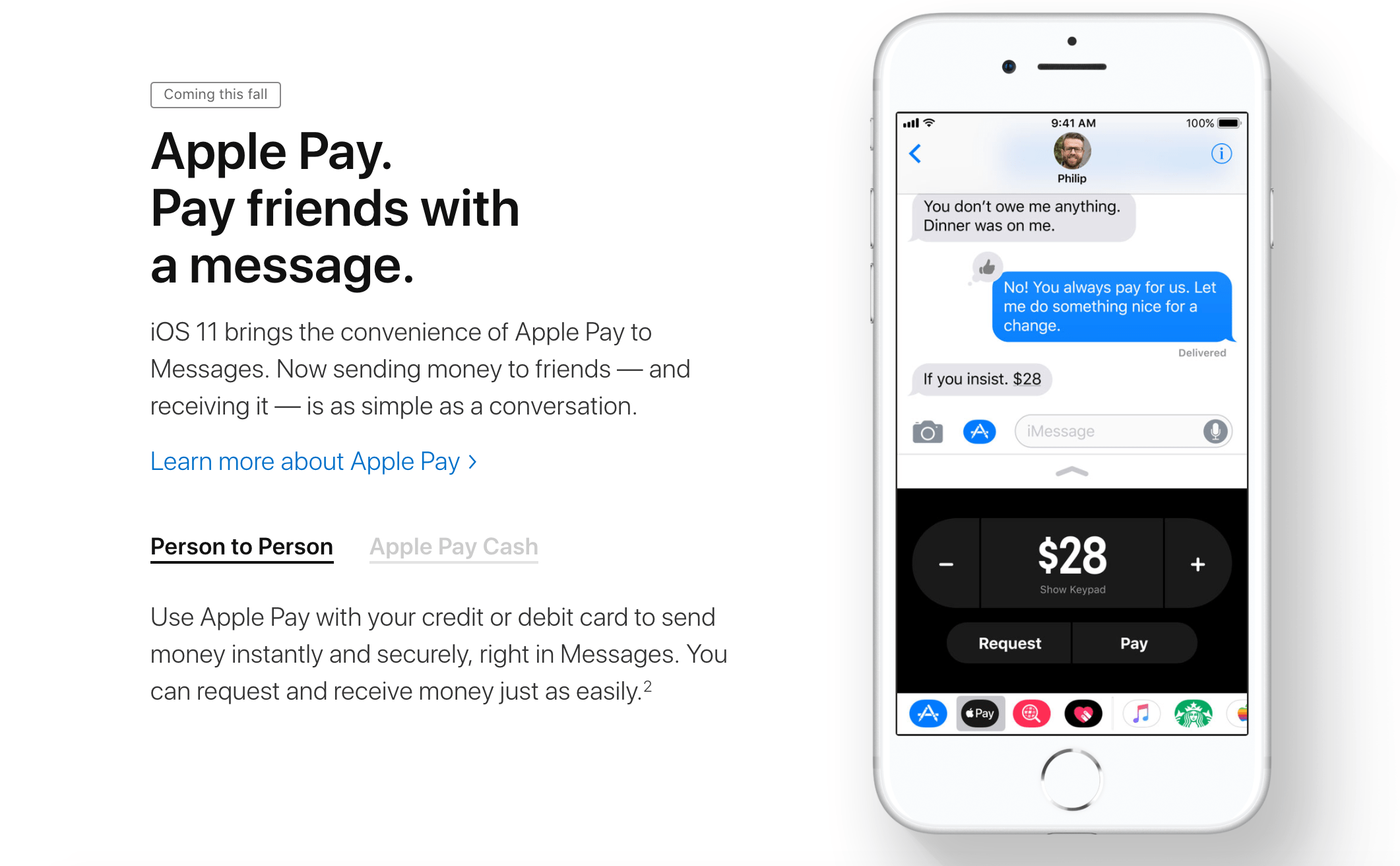

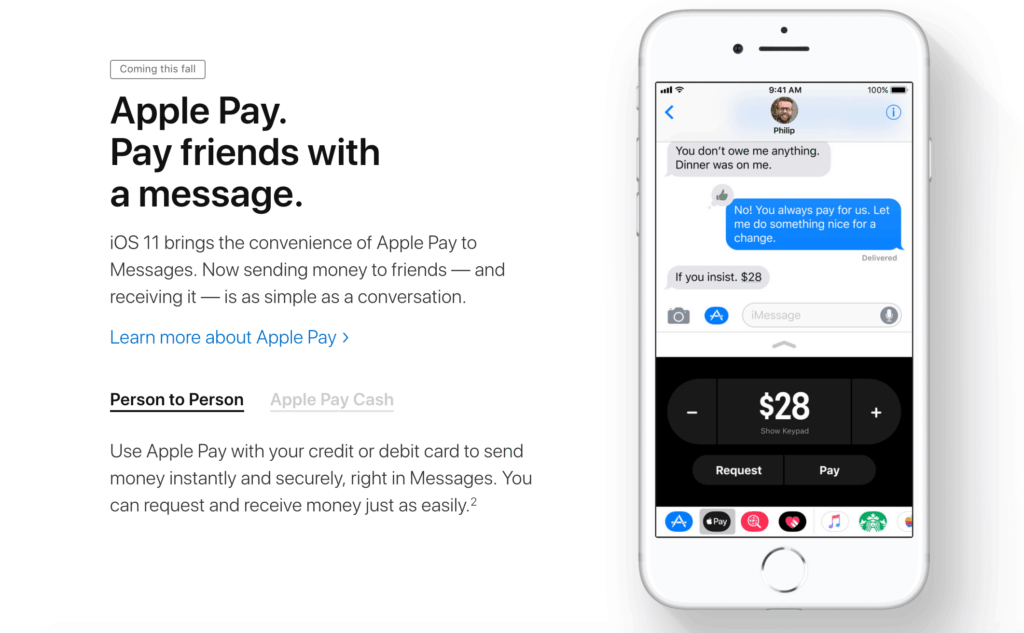

Apple Cash is integrated into the Apple Wallet and allows users to send and receive money through iMessage. It’s primarily used within the Apple ecosystem. Key features include:

* **iMessage Integration:** Send and receive money directly within text messages.

* **Apple Pay Integration:** Use your Apple Cash balance to make purchases with Apple Pay.

* **Daily Cash:** Earn cashback on Apple Card purchases that is deposited into your Apple Cash balance.

* **Direct Deposit:** Receive paychecks directly into your Apple Cash account.

* **Limited External Transfers:** Transfers are primarily within the Apple ecosystem.

Why Direct Transfers Aren’t Possible (and What You Can Do)

As of the current date, there is no direct way to transfer money from Venmo to Apple Cash or from Apple Cash to Venmo. This is because the two services operate as distinct and separate financial entities. However, there are workarounds that can help you achieve a similar result. It is important to be aware of this limitation before you try to move the funds.

Workaround 1: The Bank Account Bridge

The most common method involves using a bank account as an intermediary. This process involves transferring money from Venmo to your bank account and then from your bank account to Apple Cash (or vice versa). This approach is the most common and generally the easiest for most users.

Step-by-Step Guide: Venmo to Bank Account

1. **Open the Venmo app:** Launch the Venmo app on your smartphone.

2. **Navigate to Your Balance:** Tap the menu icon (usually three horizontal lines or your profile picture) and select “Manage Balance.”

3. **Initiate a Transfer:** Select “Transfer to Bank.”

4. **Choose Transfer Speed:** Select the transfer speed. Instant transfers usually incur a small fee, while standard transfers are free but take 1-3 business days.

5. **Enter Amount:** Enter the amount you want to transfer.

6. **Select Bank Account:** Select the bank account you want to transfer to. If you haven’t already, you’ll need to link your bank account to Venmo. This typically involves verifying your account using micro-deposits.

7. **Confirm and Transfer:** Review the details and confirm the transfer.

Step-by-Step Guide: Bank Account to Apple Cash

1. **Open the Wallet App:** Open the Wallet app on your iPhone.

2. **Select Apple Cash Card:** Tap on your Apple Cash card.

3. **Add Funds:** Tap the three dots in the upper-right corner and select “Add Money.”

4. **Enter Amount:** Enter the amount you want to add.

5. **Select Bank Account:** Select the bank account you want to transfer from. If you haven’t already, you’ll need to link your bank account to Apple Cash. This also typically involves verifying your account.

6. **Confirm and Add:** Review the details and confirm the transfer using Face ID, Touch ID, or your passcode.

Considerations for the Bank Account Bridge

* **Transfer Times:** Be aware of the transfer times associated with both Venmo and Apple Cash. Standard transfers can take a few business days.

* **Fees:** Instant transfers on Venmo incur a fee, typically a percentage of the transfer amount. Apple Cash does not usually charge fees for adding money from a bank account.

* **Bank Account Limits:** Some banks may have daily or monthly limits on transfers. Check with your bank to understand any restrictions.

Workaround 2: The Debit Card Route

Another option involves using a debit card. You can add your Venmo debit card to your Apple Cash account or vice versa (if you have the Apple Card). This method can be faster than using a bank account, but it may also involve fees. However, this is not always possible depending on the debit card.

Step-by-Step Guide: Venmo Debit Card to Apple Cash

1. **Get a Venmo Debit Card (if you don’t already have one):** Apply for the Venmo debit card through the Venmo app.

2. **Open the Wallet App:** Open the Wallet app on your iPhone.

3. **Select Apple Cash Card:** Tap on your Apple Cash card.

4. **Add Funds:** Tap the three dots in the upper-right corner and select “Add Money.”

5. **Enter Amount:** Enter the amount you want to add.

6. **Add Debit Card:** Select “Add a Card” and enter your Venmo debit card information. If the Venmo card is already linked, select the card to transfer.

7. **Confirm and Add:** Review the details and confirm the transfer using Face ID, Touch ID, or your passcode.

Considerations for the Debit Card Route

* **Fee Potential:** Review the terms and conditions of both Venmo and Apple Cash to understand any potential fees associated with using a debit card for transfers. Some cards may incur a cash advance fee.

* **Card Compatibility:** Ensure that your Venmo debit card is compatible with Apple Cash. Not all debit cards are accepted.

* **Transfer Limits:** Be aware of any daily or monthly transfer limits associated with your debit card or Apple Cash.

Troubleshooting Common Issues

Even with these workarounds, you may encounter issues. Here are some common problems and how to solve them:

Issue: Bank Account Verification Problems

* **Solution:** Double-check your bank account details (account number and routing number) for accuracy. Ensure that the name on your bank account matches the name on your Venmo or Apple Cash account. If you’re still having trouble, contact your bank or Venmo/Apple Cash support for assistance.

Issue: Transfer Limits

* **Solution:** Both Venmo and Apple Cash have daily and weekly transfer limits. Check your account settings to understand your limits. If you need to transfer a larger amount, you may need to do it in multiple transactions over several days.

Issue: Delayed Transfers

* **Solution:** Standard transfers can take 1-3 business days to process. If your transfer is taking longer than expected, contact Venmo or Apple Cash support to inquire about the status of your transfer.

Issue: Fees

* **Solution:** Be aware of any fees associated with instant transfers or using a debit card. Choose the transfer method that minimizes fees. Review the terms and conditions of both services to understand the fee structure.

Expert Tips for Managing Your Funds

Here are some additional tips to help you manage your funds effectively between Venmo and Apple Cash:

* **Plan Ahead:** If you know you’ll need to transfer money between Venmo and Apple Cash, plan ahead to avoid any delays or fees. Initiate transfers a few days in advance if you’re using standard transfers.

* **Link Multiple Bank Accounts:** Consider linking multiple bank accounts to Venmo and Apple Cash. This can give you more flexibility and help you avoid transfer limits.

* **Use Budgeting Apps:** Use budgeting apps to track your spending and manage your finances across multiple platforms.

* **Stay Informed:** Stay up-to-date on the latest features and policies of Venmo and Apple Cash. Both services are constantly evolving, so it’s important to be aware of any changes that may affect your ability to transfer funds.

Venmo to Apple Cash: Why Isn’t it Direct? (A Deeper Look)

The lack of a direct transfer option between Venmo and Apple Cash is primarily due to business and technical considerations. These platforms are owned by competing companies (PayPal and Apple, respectively) and operate within their own closed ecosystems.

* **Competition:** Both Venmo and Apple Cash want to keep users within their own platforms. Making it easy to transfer money to a competitor would reduce user engagement and potentially revenue.

* **Technical Differences:** The underlying technology and security protocols of Venmo and Apple Cash are different. Integrating the two systems would require significant technical effort and coordination.

* **Regulatory Compliance:** Financial transactions are subject to strict regulations. Integrating Venmo and Apple Cash would require navigating complex regulatory requirements in multiple jurisdictions.

The Future of Digital Payments: Will Interoperability Improve?

The future of digital payments is likely to involve greater interoperability between different platforms. As consumers demand more flexibility and convenience, payment providers will be under pressure to make it easier to transfer money between different services. However, significant challenges remain, including technical hurdles, regulatory compliance, and competitive pressures. It is possible that in the future, these transfers will become easier.

Alternative Digital Payment Platforms

While Venmo and Apple Cash are popular choices, numerous other digital payment platforms exist. Exploring these alternatives might offer solutions that better suit your specific needs.

* **PayPal:** As the parent company of Venmo, PayPal offers a broader range of services, including international transfers and business payments.

* **Cash App:** Cash App is another popular P2P payment app that allows users to send and receive money, invest in stocks, and buy Bitcoin.

* **Zelle:** Zelle is a bank-backed payment network that allows users to send and receive money directly from their bank accounts.

* **Google Pay:** Google Pay is a digital wallet that allows users to make payments online, in stores, and through the Google Pay app.

Review: Weighing the Options for Venmo to Apple Cash Transfers

Since a direct Venmo to Apple Cash transfer isn’t possible, let’s review the available workarounds and their implications. We will consider the various options to move the money.

Workaround 1: Bank Account Transfer

* **User Experience & Usability:** This method is generally straightforward, using familiar banking processes.

* **Performance & Effectiveness:** Reliably transfers funds, though standard transfers can take time.

* **Pros:**

* Widely accessible, as most users have bank accounts.

* Generally free for standard transfers.

* Secure, leveraging established banking security protocols.

* **Cons/Limitations:**

* Slower transfer times (1-3 business days for standard transfers).

* Requires linking and verifying bank accounts on both platforms.

* Potential for overdraft fees if not managed carefully.

* **Ideal User Profile:** Users who prioritize cost savings and security over speed, and who don’t need immediate access to funds.

Workaround 2: Debit Card Transfer

* **User Experience & Usability:** Relatively easy if you already have a Venmo debit card.

* **Performance & Effectiveness:** Faster than bank transfers, but potential for fees.

* **Pros:**

* Faster transfer times compared to bank transfers.

* Convenient if you already use a Venmo debit card.

* **Cons/Limitations:**

* Potential for cash advance fees from your bank.

* May not be compatible with all debit cards.

* Transfer limits may apply.

* **Ideal User Profile:** Users who need funds quickly and are willing to pay a small fee for the convenience.

Key Alternatives

* **PayPal:** Transfer from Venmo to PayPal, then withdraw to your bank and add to Apple Cash. More steps, but may be useful if you frequently use PayPal.

* **Cash App:** Similar to Venmo, but with its own ecosystem. Could be an alternative if you need a separate P2P platform.

Expert Overall Verdict & Recommendation

While neither workaround is ideal, the **bank account transfer is generally the most reliable and cost-effective option** for most users. The debit card method offers speed, but the potential for fees makes it less attractive for routine transfers. We recommend carefully weighing the pros and cons of each method based on your individual needs and circumstances. Always prioritize security and be aware of potential fees and transfer limits.

Insightful Q&A Section

Here are some frequently asked questions about transferring money between Venmo and Apple Cash:

- Can I use a prepaid card to transfer money from Venmo to Apple Cash?

Generally, no. Prepaid cards often have restrictions on where and how they can be used. It’s best to use a traditional bank account or debit card. - What happens if I enter the wrong bank account information when transferring from Venmo?

If you enter the wrong bank account information, the transfer may be rejected by the bank. In some cases, the money may be deposited into the wrong account. Contact Venmo support immediately to report the error and attempt to recover the funds. - Is it possible to cancel a transfer after it has been initiated?

Once a transfer has been initiated, it may not be possible to cancel it. Contact Venmo or Apple Cash support as soon as possible to inquire about the possibility of canceling the transfer. This depends on the timing and the transfer method. - Are there any tax implications for transferring money between Venmo and Apple Cash?

Generally, no, if you are simply transferring money between your own accounts or sending money to friends and family as a gift. However, if you are receiving payments for goods or services, you may be required to report the income to the IRS. Consult with a tax professional for personalized advice. - How do I increase my transfer limits on Venmo or Apple Cash?

To increase your transfer limits, you may need to verify your identity by providing additional information, such as your Social Security number or a copy of your driver’s license. Contact Venmo or Apple Cash support for instructions on how to increase your limits. - Can I use Venmo or Apple Cash to send money internationally?

Venmo is primarily designed for domestic transfers within the United States. Apple Cash is also limited to use within the U.S. To send money internationally, you may need to use a service like PayPal, Xoom, or Western Union. - What security measures are in place to protect my money on Venmo and Apple Cash?

Both Venmo and Apple Cash use encryption and other security measures to protect your money and personal information. They also offer features like two-factor authentication and fraud monitoring. However, it’s important to be vigilant and protect your account by using a strong password and being wary of phishing scams. - What should I do if I suspect fraud on my Venmo or Apple Cash account?

If you suspect fraud, immediately contact Venmo or Apple Cash support to report the issue. They will investigate the matter and take steps to protect your account. You should also change your password and monitor your account activity for any unauthorized transactions. - Can I use Venmo or Apple Cash with a business account?

Venmo offers business profiles for accepting payments for goods and services. Apple Cash is primarily designed for personal use, but you can use it to make purchases from businesses that accept Apple Pay. - What happens to my Apple Cash balance if I switch to an Android phone?

Apple Cash is tied to your Apple ID and can only be accessed on Apple devices. If you switch to an Android phone, you will no longer be able to access your Apple Cash balance. You will need to transfer the funds to a bank account before switching to Android.

Conclusion

While transferring money directly from Venmo to Apple Cash isn’t currently possible, the workarounds outlined in this guide provide viable solutions. By understanding the limitations and utilizing the bank account or debit card methods, you can effectively manage your funds across both platforms. The key takeaway is to plan ahead, be aware of potential fees, and prioritize security. As the digital payment landscape evolves, we may see greater interoperability in the future, but for now, these methods will help you bridge the gap between Venmo and Apple Cash. Feel free to share your experiences with transferring money between these platforms in the comments below. Contact our team of experts for a consultation on how to best manage your finances in the digital age.